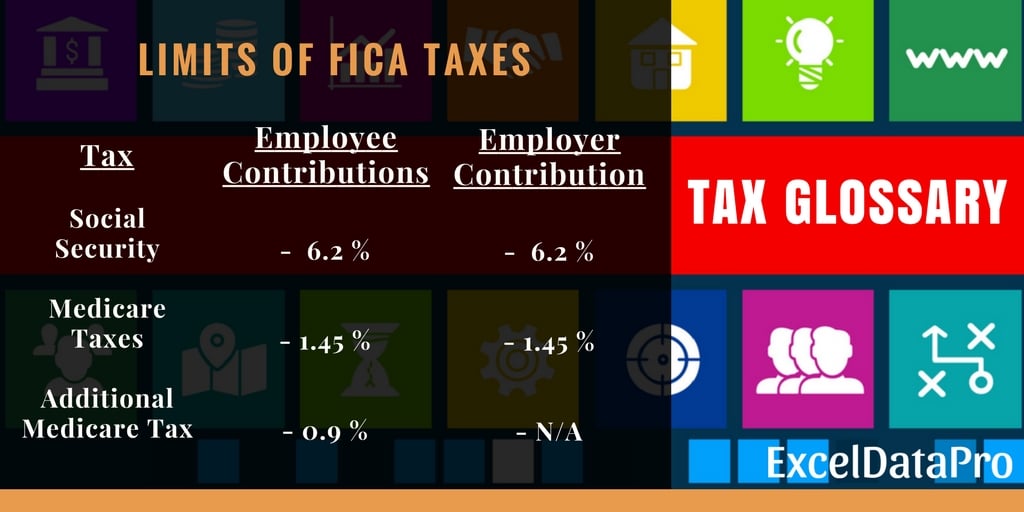

With Brightside Tax Relief, you receive comprehensive tax companies that ensure your financial well being isn’t compromised. In 2013, an Further Medicare Tax was created to cater for high-income earners. This specific tax applies to individuals who earn more than $200,000 a yr or couples filing collectively who earn more than $250,000 annually. This tax doesn’t affect the employer contribution since it’s solely the responsibility of the worker. On your paycheck, the Social Safety portion of FICA is typically labeled as “OASDI tax,” which is short for “old-age, survivors, and incapacity insurance” tax. Whether Or Not you work for an employer or are self-employed, you’re required to give the government a share of your earnings.

How Does My Tax Standing, Such As Claiming Head Of Household, Have An Result On My Fica, Medicare, And Social Security Deductions?

As A Substitute, your retirement benefit is predicated on how much you earned during your working years. You should earn a minimum variety of Social Security credits to qualify for retirement benefits. The Social Security Administration (SSA) cannot pay you advantages should you don’t have sufficient credits.

In that case, the IRS says you can elect to figure the taxable a part of a lump-sum cost for an earlier yr separately, utilizing your earnings for the previous yr. The federal government can tax up to 85% of your Social Safety benefits, so it is good to know the way these taxes are calculated. Social Safety will stop withholding taxes once you attain the utmost income quantity for the yr. However, there is not a cap on Medicare taxes, which means your whole wages are subject to the 1.45% tax. Social Security caps the amount of earnings you pay taxes on and get credit for when benefits are calculated.

The move, initiated by laws passed in March 2024, represents a significant policy shift. Some proponents say it’ll make West Virginia more attractive to retirees and ease the monetary burden on its aging inhabitants. In addition to federal taxes, some states tax Social Safety advantages. If you prefer to not have taxes deducted out of your monthly Social Safety funds, you can make quarterly estimated tax payments. Withdrawals from HSAs for certified medical bills are tax-free and don’t depend toward combined earnings.

Uber & Lyft Driver Tax Suggestions: Keep Away From Irs Bother

Simply needed to comply with up about taxr.ai – I tried it with my Workday PDF paystubs and it labored perfectly! Not solely did it explain the FICA/Social Safety distinction, however it also caught that my state withholding was barely off based on my submitting standing. Undoubtedly price testing when you’re confused about any deductions or want to ensure every thing’s correct. Completely, a monetary planning app is normally a extremely beneficial tool in accurately calculating your FICA, Medicare and Social Safety Taxes. It offers real-time tax estimates, giving you clarity about your obligations, which in flip might help in budgeting and monetary planning. Always select an app with a great status, sturdy security, and consistent updates to tax legal guidelines to ensure the most correct information.

This consists of federal withholdings corresponding to FICA, Medicare, and Social Safety https://www.intuit-payroll.org/ taxes. It’s important to regularly review and perceive these deductions to make sure right and honest payroll processing. To verify the veracity of the deductions for FICA, Medicare, and Social Security tax on a paystub, you possibly can leverage a paycheck stub maker like PaystubsNow. This software permits a person to create a paystub using their precise revenue and deduction info, which can then be compared aspect by side with an present stub for accuracy.

Both “FICA” and “Medicare” stay related; nonetheless, it’s the contributions over your working years that qualify you for these disability benefits, quite than ongoing tax deductions. Understanding this can ease issues about your financial obligations and advantages throughout a disability. If you need help or have questions on disability advantages and Medicare eligibility, please call us. The history of the FICA tax is deeply interwoven with the evolution of the Usa’ strategy to social welfare. Instituted underneath the Federal Insurance Contributions Act, this tax supports the invaluable Social Security and Medicare programs.

The paystub serves as a formal report of these transactions and can help simplify managing tax liabilities and funds. Yes, it is absolutely potential to view deductions for FICA, Medicare, and Social Safety taxes on your electronic paystub. The paystub usually provides comprehensive details about your earnings and deductions for every pay period.

- Our group can help clarify these financial elements and check should you’re entitled to additional Medicare Advantages.

- The present FICA tax fee is 15.3% of an employee’s gross wages, but solely half (7.65%) is paid by the worker, and the opposite half by the employer.

- It Is necessary to grasp that FUTA payroll tax is separate from FICA, Medicare, and Social Safety taxes.

- As mentioned above, employers and workers break up the entire amount owed in FICA taxes each pay period.

- If you need assistance understanding how your bonus impacts your contributions or have questions about Medicare eligibility, we’re ready to assist you.

FICA ensures continuous funding for beneficiaries and helps preserve the monetary stability of those crucial federal applications. It’s important to understand that FUTA payroll tax is separate from FICA, Medicare, and Social Security taxes. The Federal Unemployment Tax Act (FUTA) is a tax that employers are solely answerable for paying.

Even if a family earns enough to avoid paying federal income tax, the Social Security tax should be deducted from their wages. A single taxpayer incomes $10,000 in gross revenue in a given 12 months, for example, will owe no earnings tax, however 6.2 p.c could additionally be deducted for Social Security. If you wish to ensure your payroll reflects correct deductions for FICA, Medicare, and Social Safety taxes, you’ll have the ability to create a paystub utilizing our automated device at PaystubsNow. Our tool is designed to precisely calculate these deductions based mostly on present tax legal guidelines, providing you with a detailed and accurate paystub.